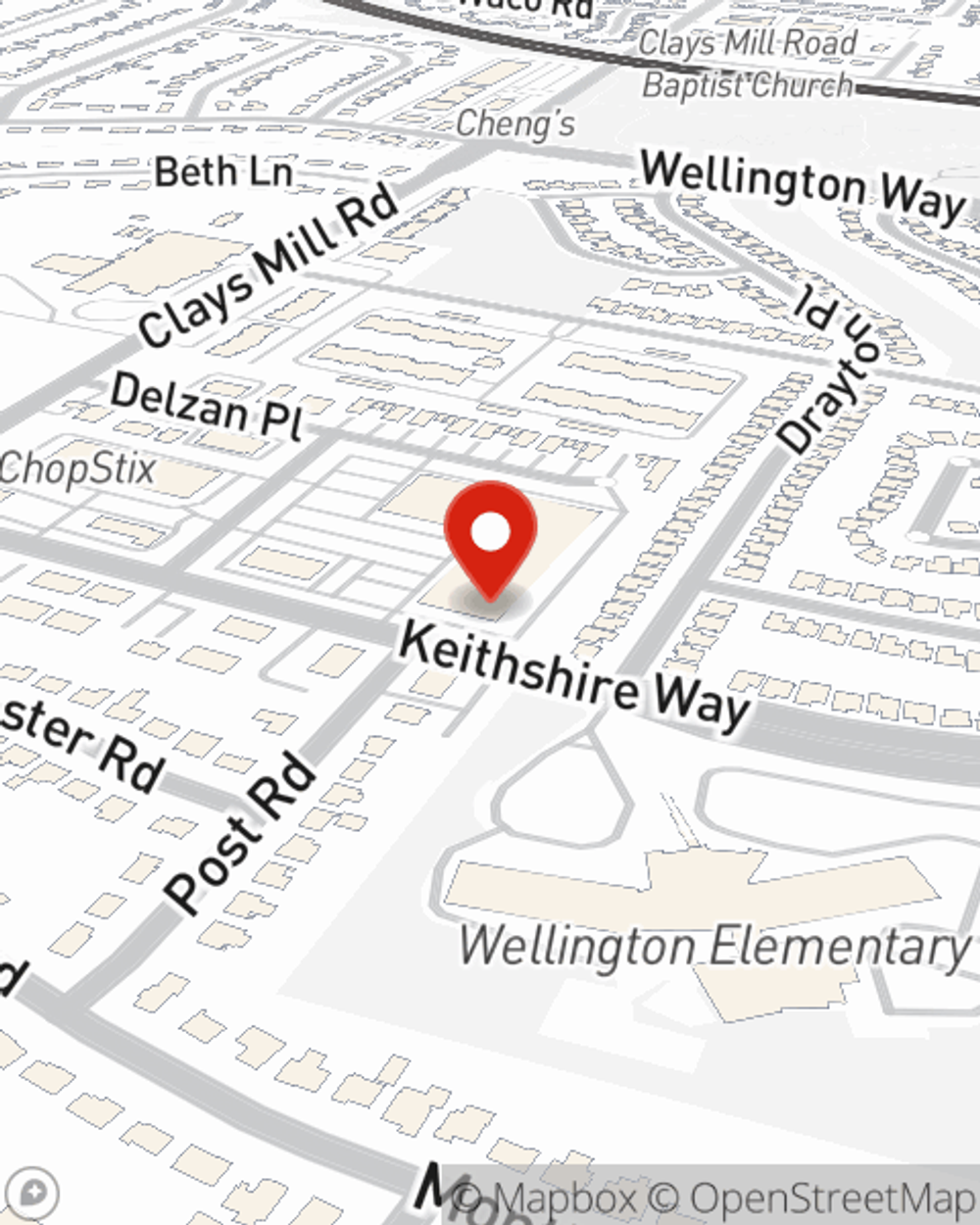

Business Insurance in and around Lexington

Looking for small business insurance coverage?

Insure your business, intentionally

This Coverage Is Worth It.

You've put a lot of elbow grease into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a tailoring service, a toy store, a hearing aid store, or other.

Looking for small business insurance coverage?

Insure your business, intentionally

Get Down To Business With State Farm

Every small business is unique and faces a different set of challenges. Whether you are growing a shoe repair shop or an interpreter, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your space, you may need more than just business property insurance. State Farm Agent Michelle Oberto can help with extra liability coverage as well as key employee insurance.

The right coverages can help keep your business safe. Consider contacting State Farm agent Michelle Oberto's office today to learn about your options and get started!

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Michelle Oberto

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.